When considering short-term financial relief, explore title loan alternatives like secured personal loans for lower interest rates and asset retention. Avoid Houston's traditional title loans with high rates and debt traps by comparing lenders who assess repayment ability and provide transparent pricing based on asset valuation. This empowers informed decisions and prevents financial instability.

Looking for a quick financial fix? Title loans may seem like an attractive option, but they often come with high-interest rates and stringent repayment terms, potentially leading to a debt trap. This article explores safer credit alternatives and strategies to avoid such pitfalls. Discover how to navigate your finances without falling victim to the risks associated with title loans, and find out about the various title loan alternatives available today.

- Understanding Title Loan Risks and Costs

- Exploring Safer Credit Alternatives

- Strategies to Avoid Debt Trapping

Understanding Title Loan Risks and Costs

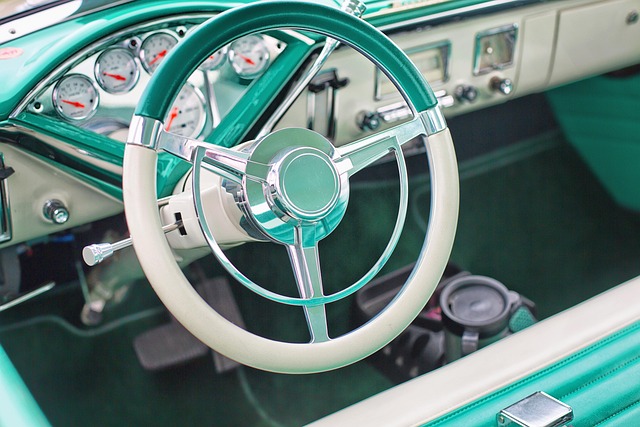

When considering title loan alternatives, it’s crucial to first grasp the potential risks and costs associated with this type of lending. Title loans are secured by your vehicle’s title, making them appealing for quick cash needs. However, these short-term loans often come with high-interest rates, and if you fail to repay, you could lose your vehicle. The interest rates can vary widely, and many borrowers find themselves in a cycle of debt, taking out one loan to cover another due to the rapid accrual of fees.

Understanding these risks is essential when exploring title loan alternatives. Online applications for financial assistance are readily available, but it’s crucial to research and compare lenders to ensure you’re getting a fair deal. A reliable lender will consider your ability to repay and offer transparent terms, including a clear breakdown of interest rates and potential fees based on your vehicle’s valuation. This approach can help prevent the pitfalls of debt traps and empower borrowers to make informed decisions regarding their financial needs.

Exploring Safer Credit Alternatives

When considering short-term financial solutions, it’s crucial to explore safer credit alternatives to avoid the pitfalls of traditional Houston title loans. Opting for title loan alternatives can help individuals navigate their monetary challenges without falling into a debt trap. One such alternative is secured personal loans, which offer lower interest rates and more flexible repayment terms compared to title loans. These loans use an asset, like your vehicle ownership, as collateral, providing access to funds while keeping the risk relatively low.

By choosing these safer options, borrowers can benefit from quick approvals without sacrificing long-term financial stability. Unlike Houston title loans, which require giving up vehicle ownership during the loan period, secured personal loans allow individuals to retain control over their assets while accessing much-needed capital. This approach empowers folks to manage their finances effectively and avoid the stress of high-interest rates and restrictive terms often associated with traditional title lending practices.

Strategies to Avoid Debt Trapping

When considering short-term financial solutions, it’s crucial to understand how to avoid falling into a debt trap. One of the most effective strategies is to explore title loan alternatives. Traditional title loans in Houston, while quick, often come with exorbitant interest rates and strict repayment terms that can leave borrowers in a cycle of debt. Instead, individuals can opt for secured loans, which use an asset like a car or property as collateral, offering potentially lower interest rates and more flexible terms.

By choosing title loan alternatives like secured loans, borrowers can effectively manage their finances without the burden of overwhelming debt. A well-planned loan payoff strategy, combined with the security of collateral, ensures that the borrower retains control over their financial future. This proactive approach allows for a fresh start and avoids the pitfalls associated with high-interest title loans.

In light of the above, it’s clear that relying on title loans can lead to a cycle of debt. However, by exploring safer credit alternatives and implementing strategies to avoid debt trapping, individuals can protect their financial stability. Remember that understanding the risks and costs associated with title loans is the first step towards making informed decisions about managing your finances. Today, there are numerous title loan alternatives available that offer more favorable terms and conditions, helping you steer clear of potential financial pitfalls.