Before turning to title loans, explore alternatives like semi-truck loans for better financial stability. Secured loans offer lower interest rates and flexible terms. Peer-to-peer (P2P) lending provides access but comes with higher interest rates and less oversight. Thorough research is crucial to balance flexibility with potential risks of alternative cash solutions.

Considering a title loan but want to explore safer options? You’re not alone. Before deciding, understand the basics of title loans and weigh their drawbacks. This article guides you through powerful alternatives: secure loans, peer-to-peer lending, highlighting benefits and risks. Make an informed decision by comparing these title loan alternatives and choose what best suits your financial needs.

- Understanding Title Loan Basics: What You Need to Know

- Exploring Secure Loans: A Viable Alternative

- Peer-to-Peer Lending: Benefits and Risks Compared

Understanding Title Loan Basics: What You Need to Know

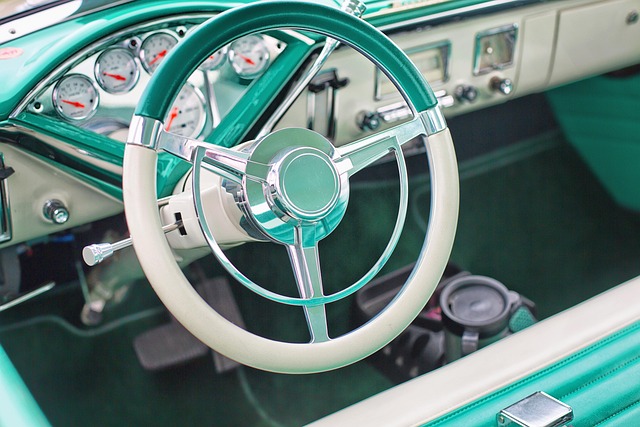

Before considering a title loan, it’s crucial to understand its fundamentals and explore available alternatives. A title loan is a secured lending option where borrowers use their vehicle’s title as collateral. Lenders offer quick access to cash with relatively lenient credit requirements, but the cost can be high due to interest rates and fees. The process typically involves providing your vehicle’s title, undergoing a brief inspection, and receiving funds within a short time frame. However, borrowers face significant risks if they fail to repay, potentially leading to permanent loss of their vehicle.

Understanding these basics is essential as it empowers borrowers to make informed decisions about their financial needs. Exploring Title Loan Alternatives offers flexible payments and repayment options that might better suit individual circumstances, such as semi-truck loans for those in the trucking industry. By comparing various choices, you can avoid the potential pitfalls of title loans and opt for a solution that provides more long-term financial stability.

Exploring Secure Loans: A Viable Alternative

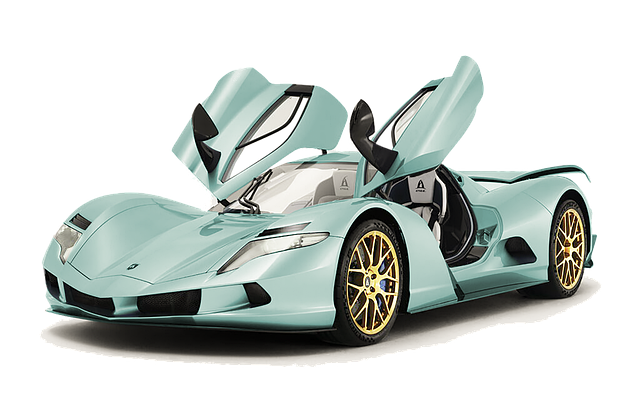

When considering fast cash solutions, it’s essential to explore secure loan alternatives that offer a more stable and long-term option than traditional title loans. Secured loans are a viable choice for individuals seeking repayment flexibility and lower interest rates. These loans use an asset, such as a vehicle or property, as collateral, providing lenders with security and potentially resulting in better terms for borrowers.

By opting for secured loans, you gain access to various repayment options tailored to your financial comfort zone. This approach allows you to avoid the stringent deadlines often associated with title loans, offering a more manageable path to financial stability. In today’s market, exploring these alternatives can be a game-changer, ensuring you secure funding without compromising long-term financial health.

Peer-to-Peer Lending: Benefits and Risks Compared

Peer-to-peer (P2P) lending has emerged as a popular alternative to traditional title loans, offering both benefits and risks for borrowers. One of the key advantages is the accessibility it provides, especially for individuals with less-than-perfect credit or no credit history. Unlike banks that often require extensive documentation and strict eligibility criteria, P2P lenders operate on a more inclusive model. Borrowers can apply for loans without a credit check, making it an attractive option for those in urgent need of cash.

However, the risk lies in the potential for higher interest rates and less regulatory oversight. Since these platforms connect borrowers directly with lenders, there’s often less structure around repayment options, leading to varying terms and conditions. While this flexibility can be advantageous, it might also complicate the borrowing process and increase financial strain if not managed carefully. Thus, while P2P lending offers a more accessible financial solution for some, it requires thorough research and understanding of the associated risks.

When considering title loan alternatives, it’s crucial to weigh the benefits and drawbacks of each option. After exploring this article’s discussions on understanding title loans, secure loans, and peer-to-peer lending, you’re now equipped to make an informed decision. Remember that while title loans offer quick access to cash, there are safer and more sustainable options available, such as secure loans or peer-to-peer lending platforms. Always compare your financial needs with the terms of each alternative before committing to a decision.