Peer-to-peer (P2P) lending platforms offer a revolutionary title loan alternative by directly connecting borrowers and lenders, bypassing banks. This accessible system allows participants with stable income and credit history, provides collateral protection for lenders, and potentially lower interest rates for borrowers compared to conventional title loans like Motorcycle Title Loans in Houston. P2P loans simplify the process, cater to less-than-perfect credit scores, but carry risks of higher rates and default consequences; evaluating repayment capacity is crucial for informed decisions.

Tired of traditional lending options? Explore peer lending as a powerful title loan alternative. This decentralized approach connects borrowers directly with lenders, offering a fresh perspective on short-term financing. In this article, we dissect the advantages and risks of peer-to-peer (P2P) loans compared to title loans, helping you make informed decisions. Understand the landscape, navigate potential pitfalls, and unlock flexible borrowing opportunities in today’s digital era.

- Understanding Peer Lending: A Decentralized Approach

- Advantages of Peer-to-Peer Loans Over Title Loans

- Navigating Risks and Benefits: A Comprehensive Look

Understanding Peer Lending: A Decentralized Approach

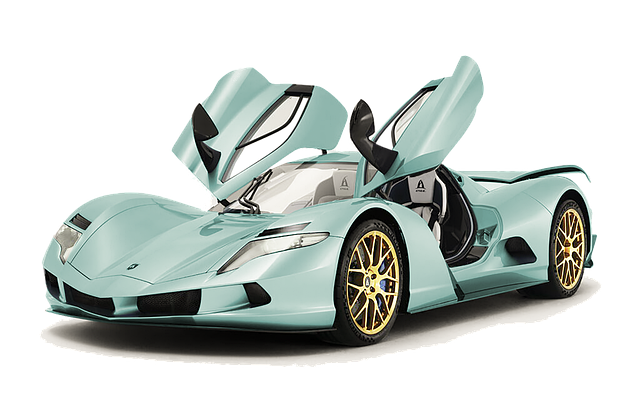

Peer lending represents a decentralized financial system where individuals borrow and lend money directly to one another, bypassing traditional banking institutions. This innovative approach has emerged as a viable alternative to Title Loan alternatives, offering borrowers a more flexible and accessible option for short-term financing. By connecting lenders and borrowers on an online platform, peer lending platforms democratize access to capital, allowing anyone with a stable income and a clear credit history to participate.

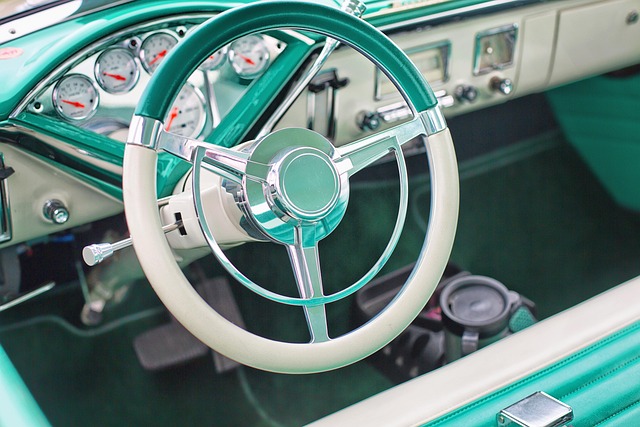

This decentralized model facilitates secured loans, where borrowers use an asset as collateral, such as a vehicle (including motorcycles in the case of Motorcycle Title Loans) or real estate. This practice ensures lenders have some protection against default, potentially leading to lower interest rates for borrowers compared to traditional title loans. For instance, residents of Houston Title Loans can explore peer lending options that provide a more transparent and competitive borrowing experience while leveraging their assets as security.

Advantages of Peer-to-Peer Loans Over Title Loans

Peer-to-peer (P2P) loans offer a compelling alternative to traditional title loans for borrowers seeking quick cash. One of the primary advantages is their accessibility; P2P lending platforms streamline the borrowing process by connecting lenders and borrowers directly, eliminating the need for intermediaries. This not only reduces costs but also makes it easier for individuals with less-than-perfect credit to gain access to financing since a thorough credit check isn’t always required to secure a loan.

Moreover, P2P loans often come with more flexible terms compared to title loans, providing borrowers with better repayment options. Unlike title loans that require the transfer of asset ownership as collateral, P2P loans typically don’t demand such a significant security interest. This reduces the risk for borrowers and allows them to retain full control over their assets while still accessing much-needed funds.

Navigating Risks and Benefits: A Comprehensive Look

Peer lending, a revolutionary concept in financial services, offers an intriguing alternative to traditional title loans. As more individuals seek flexible borrowing options outside the realm of conventional banking, understanding both the risks and benefits of peer-to-peer (P2P) lending is paramount. This comprehensive look aims to demystify this modern approach to loaning, specifically comparing it with title loan refinancing.

One of the primary advantages of peer lending as a title loan alternative lies in its accessibility. Unlike secured loans that require significant collateral, P2P platforms often cater to borrowers with less-than-perfect credit, offering them a chance at financial relief. Moreover, direct deposit capabilities ensure a swift and secure transaction process. However, it’s crucial to acknowledge the risks involved. With higher interest rates compared to some traditional methods, peer lending may not always be the most cost-effective option. Borrowers must carefully evaluate their repayment capacity to avoid default, which could impact their credit score and future borrowing opportunities. Balancing these factors is key to making an informed decision when considering peer lending as a viable title loan alternative.

Peer lending platforms offer a compelling alternative to traditional title loans, providing borrowers with flexible options and competitive rates. By embracing this decentralized approach, individuals can access much-needed funds without the stringent requirements often associated with title loans. While risks exist, a thorough understanding of both sides allows borrowers to make informed decisions, ensuring peer lending remains a viable title loan alternatives in today’s financial landscape.